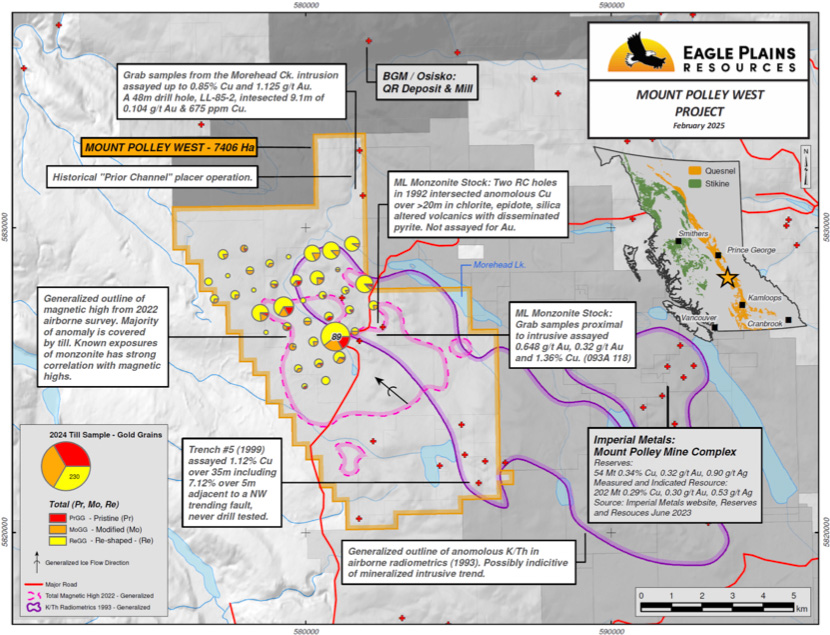

Vancouver, B.C. June 19, 2025 – Tana Resources Corp. (“TANA” or the “Company”) (CSE: TANA) is pleased to announce it has entered into an option agreement dated 2025-Jun-17 with Eagle Plains Resources Ltd. (“EPL”) to acquire up to a 75% interest in the 7,406.63 hectare Mount Polley West (“MPW”) located 54 kms north-northeast of Williams Lake and adjacent to Imperial Metals’ Mount Polley Property, in British Columbia’s Cariboo region. MPW is prospective for porphyry copper and epithermal precious metals. Key highlights include:

- Historical trenching returned 1.12% Cu over 35m, including 7.12% Cu over 5m

- Historic exploration has documented

- multiple mineralized intrusions similar in nature to the Mount Polley Intrusive Complex (MPIC)

- coincident geophysical and geochemical anomalies that support the presence of additional prospective intrusions

- EPL exploration has located down-ice gold grain in till counts indicative of potential proximal sources

“We are excited to add the Mount Polley West project to the Tana portfolio and work with the Eagle Plains, one of the top project generators,” commented Tana CEO Vic Koraijan. “The historic compilation in combination with the recent work by Eagle Plains has identified excellent porphyry and epithermal targets in a known mineral rich belt,” he added.

Chuck Downie, President and CEO of Eagle Plains commented “Grassroots fieldwork by Eagle Plains and past operators at MPW has identified many of the geological indicators associated with porphyry and epithermal mineralizing systems and we look forward to working with the Tana team to advance the Project. The excellent access and proximity to infrastructure will support very cost-effective exploration”

The MPW property lies in the Quesnel Trough and is underlain by the Triassic Nicola Group volcanics and volcaniclastics intruded by coeval and younger small stocks, plugs and dykes of syenitic to monzodioritic composition, a setting similar to the Mount Polley Mine approximately 5 kilometres to the east. In addition, 10 documented BC MINFILE mineral occurrences lie within the MPW property boundaries, primarily copper showings. The general location, occurrences and key targets are shown in Figure 1.

Tana cautions investors rock grab samples are selective samples by nature and as such are not necessarily representative of the mineralization hosted across the MPW property.Some of the above results were taken directly from MINFILE descriptions and assessment reports (ARIS) filed with the BC government. Management cautions that historical results were collected and reported by past operators and have not been verified nor confirmed by a Qualified Person but form a basis for ongoing work on the MPW property. Management cautions that past results or discoveries on proximate land are not necessarily indicative of the results that may be achieved on the MPW property.

Technical sources:

- Kikauka, A. (1999). Geological and Geophysical Report on the J 1-4 Claim Group, Jacobie Lake, Likely, B.C.. (File No. 25960)

- Montgomery, A. (1990). 1990 Assessment Report on a Prospecting and Geological Work Program, JC 1 & 2 Mineral Claims, Cariboo Mining Division (File No. 20792)

- Downie, D., & Schmidt, N. (2022). 2022 Airborne Geophysical Survey of the ML Property, near Williams Lake, B.C.. Dahrouge Geological Consulting Ltd. (File No. 40295)

- Baich, Ashton. (2025). 2024Mount Polley West Project Assessment Report (Filed for Assessment Mar. 14, 2025)

Agreement

Tana can earn an initial 60% interest in the MPW property by completing the following cash payments and share issuances and incurring the following exploration expenditures:

| Date | cash payment | share issuance | expenditures |

| on signing | $5,000 | 250,000 | |

| 2025-Dec-31 | $20,000 | 250,000 | $75,000 |

| 2026-Dec-31 | $50,000 | 500,000 | $325,000 |

| 2027-Dec-31 | $75,000 | 750,000 | $1,000,000 |

| 2028-Dec-31 | $100,000 | 1,000,000 | $1,600,000 |

| Totals | $250,000 | 2,750,000 | $3,000,000 |

Following the completion of the initial option terms, Tana can earn an additional 15% interest, to a total of 75%, upon completion of a feasibility-level study by December 31st, 2031, provided Tana indicates its intention to complete the study by December 31st, 2028.

Thirteen of the tenures underlying the MPW property have an underlying 2% NSR, 1% of which can be repurchased by Eagle Plains for $1,000,000. Six of those twelve have a second underlying NSR of 1%, which can be reduced to 0.5% by making a payment of $750,000. If Tana exercises the First or Second Option, Eagle Plains will be granted 2% NSR on the remaining seven tenures, which Tana can reduce to 1% through a payment of $1,000,000. No areas of the MPW property have a greater than 3% NSR before reductions.

Eagle Plains will serve as Operator under industry-standard terms until Tana has completed the earn-in requirements as outlined above. As Operator, Eagle Plains may charge a 10% Operators Fee and reserves the right to employ the services of TerraLogic Exploration Services as geoscience consultant.

Following the exercise of its Option, Tana and EPL shall form a joint venture at either 60/40 or 75/25 at Tana’s election for further exploration and development of the MPW Property.

Financing

Tana intends to undertake a financing to be in an amount and upon terms to be determined in the context of the market.

Double T Property

Tana has determined to lapse the the option on the Double T Property to focus its resources on the WMP project.

Certain technical information, including historical results or exploration activity are provided for context only and have not been verified by Tana and as such readers are cautioned not to rely on such information in assessing the merit of the property or the Company.

The technical content of this news release has been reviewed and approved by R. Tim Henneberry, P.Geo. (BC), a Director of the Tana and a Qualified Person under National Instrument 43-101.

“Vartan Korajian”

President and CEO

For further information, please contact:

778-855-3994

Email: [email protected]

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.”

Forward Looking Statements:

Forward Looking Statements: The information in this news release contains forward looking statements that are subject to a number of known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from those anticipated in our forward-looking statements. Factors that could cause such differences include: changes in world commodity markets, equity markets, costs and supply of materials relevant to the mining industry, change in government and changes to regulations affecting the mining industry and to policies linked to pandemics, social and environmental related matters. Forward-looking statements in this release include statements regarding future exploration programs, operation plans, geological interpretations, mineral tenure issues and mineral recovery processes. Although we believe the expectations reflected in our forward-looking statements are reasonable, results may vary, and we cannot guarantee future results, levels of activity, performance or achievements. Tana Resources disclaims any obligations to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as may be required by applicable law.